Between non-compliance with tax obligations and the crime of tax evasion there is a short path that, at the end of 2021, nine taxpayers traveled in Ciego de Ávila, after the National Tax Administration Office (ONAT) exhausted legal and enforcement resources, without results.

The nine self-employed workers, eight from Morón and one from the main city, committed this type of crime and were tried in the Criminal Chamber, as their debts were determined and the term of the request for payment expired. Maidelis Díaz Aragón, first deputy director of the provincial ONAT, said that the amount of the debt is greater than five million pesos.

This figure explains the penalties of deprivation of liberty, between three and four years, and correctional work with and without internment, as well as the mandate to pay the total debt contracted with "the treasury."

Díaz Aragón recalled that the taxes collected by the Cuban State allow supporting many of the social expenses, saying Education, Health and Social Assistance. The directive specified that the ONAT has a term of up to five years to process the files for Tax Evasion.

In 2017, ONAT prosecuted and presented to the courts more than 200 tax evaders. A Workers' report referred to the issue. A year later, the media itself said that 67 sentences were issued for tax evasion, with 155 people sanctioned. While at the end of July 2019 there were already 71 taxpayers found guilty of this crime, which carries penalties of up to eight years in prison.

According to the provincial deputy director, non-payment of contributions is the biggest problem facing the tax office in Ciego de Ávila today, "because non-payment of taxes, in addition to being a serious indiscipline, leads to a lack of financing in the Budget, which slows down or prevents the execution of works of public good”.

Indiscipline today takes shape in several "modalities": falsifying information, omitting income received, having the Income and Expenditure Registry out of date, not adjusting the accounting and the registry of its operations to current regulations or not keeping the accounting that is required, among other.

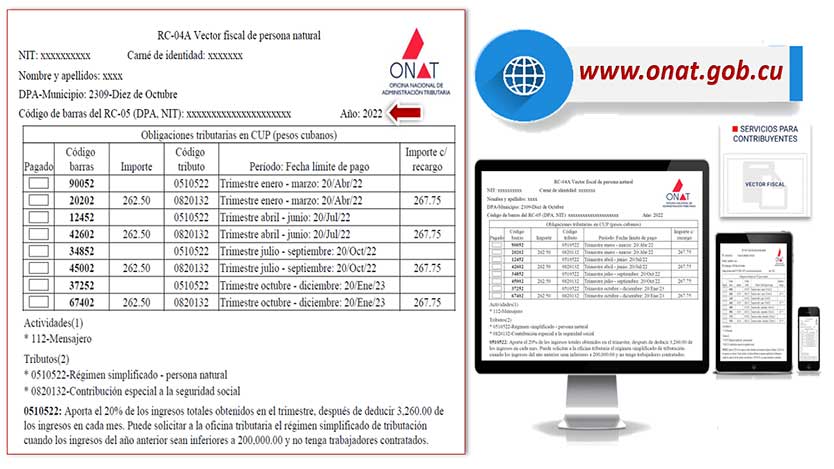

In this sense, a note published on the tax portal (www.onat.gob.cu) reports the execution of fiscal operations to support popular control actions against price increases. With the aim of "verifying tax compliance with pecuniary (payment) and non-pecuniary (formal duties) obligations of previously selected taxpayers and identifying natural persons who exercise without being registered (illegal)", throughout the country they are performing these operations.

Until February, 137 taxpayers (self-employed workers) were identified in Ciego de Ávila´s properties in breach of their obligations and one illegal, to whom debts were determined or fines were applied, for a value greater than 198,000.00 pesos.

Morón and the capital city are the territories with the highest incidence of fiscal indiscipline, but in general, all municipalities have delinquent taxpayers, a behavior identified as prone to evasion.

The ONAT note indicates that, in total, 2,681 fiscal control actions were carried out against price increases, all on natural persons, which resulted in the determination of debts with the State Budget amounting to more than 10 million pesos. , at the close of last March 21.

The most important fact found in this fiscal control, details the publication, "was the non-correspondence between the income and the contributions made: the former grew due to the increase in prices, while the latter, which should have also done so, did not experience the corresponding increase. Which was a clear indicator of underreporting.”

In fact, 70 percent of the debts were caused by underreporting. “It was found that more than seven million pesos were not contributed, to which added more than 200,000 corresponding to the Surcharge for Arrears were established for liquidating outside the legally established date.”