The 2023 year started as a “tumultuous one” for the Cuban bank that, these days, monopolizes headlines and moves popular comment, after last January 10, the Metropolitan Bank reported on the establishment of limits on bank operations for cash extraction and transfers, made through electronic channels.

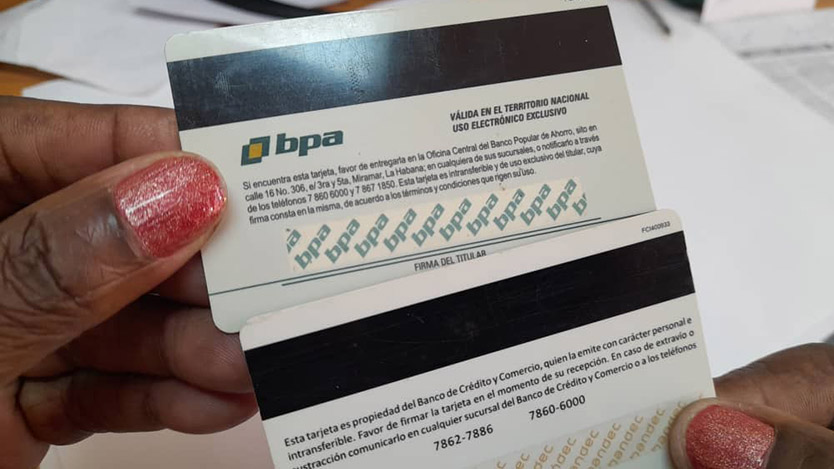

Since the 12th, the measure, which has not been able to escape controversy, also became effective in the branches of the Credit and Commerce (BANDEC) and Saving Popular (BPA) banks.

In the case of the doubts that arose in the population after the implementation of the new provision, Loida Hernández Alejo, commercial deputy director of BANDEC in Ciego de Ávila, explained to Invasor that this is not an exclusive initiative of Cuba, but a regulation that exists throughout the world and that the bank uses to protect the different payment channels and order the flow to achieve greater transparency in operations, but, "it does not limit, at any time, that people can extract their money".

As the Central Bank of Cuba clarified in recent days, the establishment of limits on customer transactions, according to the nature of the operations, responds to an international financial practice of applying due diligence in banks, since Cuba is a signatory of the conventions of Vienna (United Nations Convention against Illicit Traffic in Narcotic Drugs and Controlled Substances), Palermo (United Nations Convention against Transnational Organized Crime), and Mérida (United Nations Convention against Corruption).

Regarding the recently implemented decision, Vlamir Rodríguez Fernández, head of BANDEC's Electronic Banking Department in the province, pointed out that it includes the operations of personal accounts related to salary, retirement, savings, fund formation and collaboration, from which movements are carried out between natural persons and for which a daily limit of up to 80,000 Cuban pesos (CUP) per operation is established, and a maximum of up to 120,000 CUP per month; while in the case of the Freely Convertible Currency (MLC) the daily limit per operation is up to 1,000, and a monthly maximum of up to 5,000.

For their part, those clients who need to carry out operations with another natural person that exceed the established amounts, must go to the bank branches to request it and sign an affidavit of origin and destination, which, in the words of the commercial deputy director, "does not It means that the origin of that money is going to be questioned, but rather that both the bank and the client can demonstrate the legality of the operation”.

The limitations, he pointed out, do not cover transactions made from personal accounts as part of the payment to legal entities or other economic actors of society for any reason (goods or services purchased, reservations for tourist facilities, payment in units of Commerce or Gastronomy, among others).

Likewise, the measure does not apply to cash movements that are made between legal persons and other agents of the economy (self-employed workers, cooperatives or micro, small or medium-sized private companies) from their corporate accounts, since, as these are linked to the business, they are related to payments and activities authorized in its corporate or business purpose.

These limits, specified Lisandra Ruiz Palmero, compliance officer at BANDEC, had been implemented since February 2022 for operations carried out by natural persons in bank branches, only now it was decided to extend them to virtual operations carried out through channels of payment, given the increase in its use in recent times, the growing number of customers who operate magnetic cards, the high prices and the inflation that the country is experiencing.

Although for many the provision is arbitrary, the statistics show that these limits respond to the way in which these accounts are operated in the banks, because, according to Yelegnis Fernández Castro, general director of the Electronic Banking of the Metropolitan Bank, in a report by colleague Lázaro Manuel Alonso, during the month of December only 0.2 percent of clients carried out operations for more than 80,000 CUP, while for more than 120,000 CUP per month, only 0.1 percent did so.

If there is something to question, it is that at this point the logic is inverted and decisions of this type are first implemented and then reported. Where is communication and the right to timely information? On the other hand, isn't good customer service also about that?