At the close of the first half of April ―and with just another 15 days left for the closing of the Campaign for the Affidavit of the Personal Income Tax obtained in 2022―, only 52 percent of the potential taxpayers in the province had complied with this important step in fiscal and tax discipline.

Beatriz Ramos Ibarra, provincial director of the National Tax Administration Office (ONAT), told Invasor that even though the potentials continue to be refined (and will be updated in the last week of this month), taking into account that some taxpayers left the country without restore their status, the percentage of declarants is well below what is required at this point in the campaign.

Among the main causes for the delay, the specialist does not disdain a particularity of this year: since January all self-employed workers, both those of the general regime and those of the simplified one, present the affidavit, as provided by Law No.157 of the State Budget for 2023. Hence, the number of those who must prepare the DJ08 (self-employed; artists and creators from the Culture sector, and their support staff; social communicators and designers; and workers from foreign branches who receive bonuses) will be has increased to 14,274.

Of this total, barely 41 percent has filled its DJ, with Chambas, Ciego de Ávila and Venezuela being the territories with indicators below the provincial average.

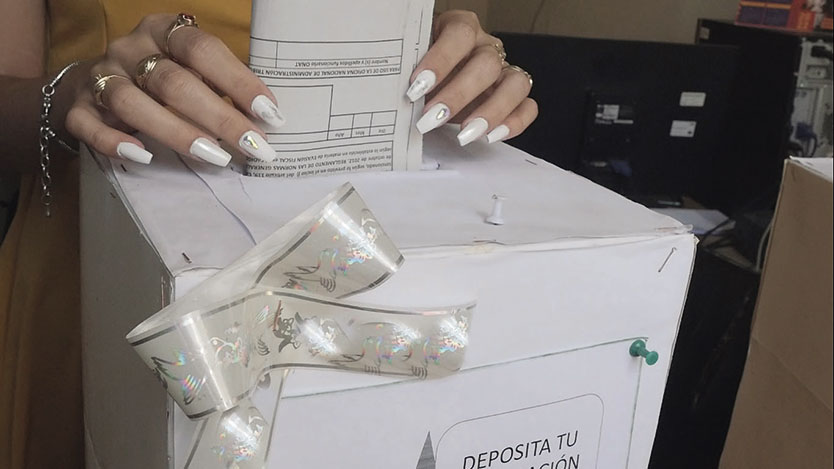

By virtue of this, Ramos Ibarra explained, ONAT has developed training actions. "We have identified concentration points for taxpayers, such as self-employed sales areas, entrances for pedicab drivers, supply and demand markets, and our specialists and technicians have moved there."

Taxpayers in the agricultural sector are not in the same situation, since at the close of the information almost 80 percent had already submitted their documentation. Below that level, only Chambas and Majagua remained.

This process has advantages and consequences, depending on whether or not it is completed on time. For taxpayers who declare and pay the tax before February 28, 5 percent of the amount to be paid is discounted as a prompt payment bonus, and if they make the contribution by Transfermóvil or Telebanca, they are also discounted 3 percent for using this electronic channel.

The ONAT director, asked about the consequences of not presenting the affidavit in the established time, said that the first thing is to identify and classify those who fail to comply with this important step of fiscal discipline as campaign defaulters. Then, the Office applies a surcharge for late payment and applies tax penalties for failure to declare the responsibility.